Keppel expects to book approximately S$3.4 billion[1],[2] gain in earnings accretive transaction.

Keppel Corporation Limited (Keppel) wishes to announce that its shares will trade ex-dividend, in relation to the distribution in specie (DIS) of approximately 19.1 Sembcorp Marine (SCM) shares per Keppel share held, when market opens on 23 February 2023.

Following completion of the combination of Keppel Offshore & Marine and SCM on 28 February 2023, Keppel will receive 54% or 36,848,072,918 shares of SCM with a total implied value of about S$4.5 billion[3] and will distribute in specie 49% of the shares or approximately 19.1 SCM shares for every Keppel share held.

Arising from the completion of the combination, Keppel expects to book a substantial disposal gain of approximately S$3.4 billion[1],[2]. While the distribution in specie to Keppel shareholders has an implied value of approximately S$4.1 billion[4], as it will be paid out largely from the disposal gain, it will only have a marginal impact of S$0.28 per share[1],[4] to Keppel’s Net Tangible Assets (NTA) for FY 2022 on a pro forma basis[2]. Conversely, if there had not been a corresponding significant transaction gain booked, the distribution in specie would have been more dilutive to NTA.

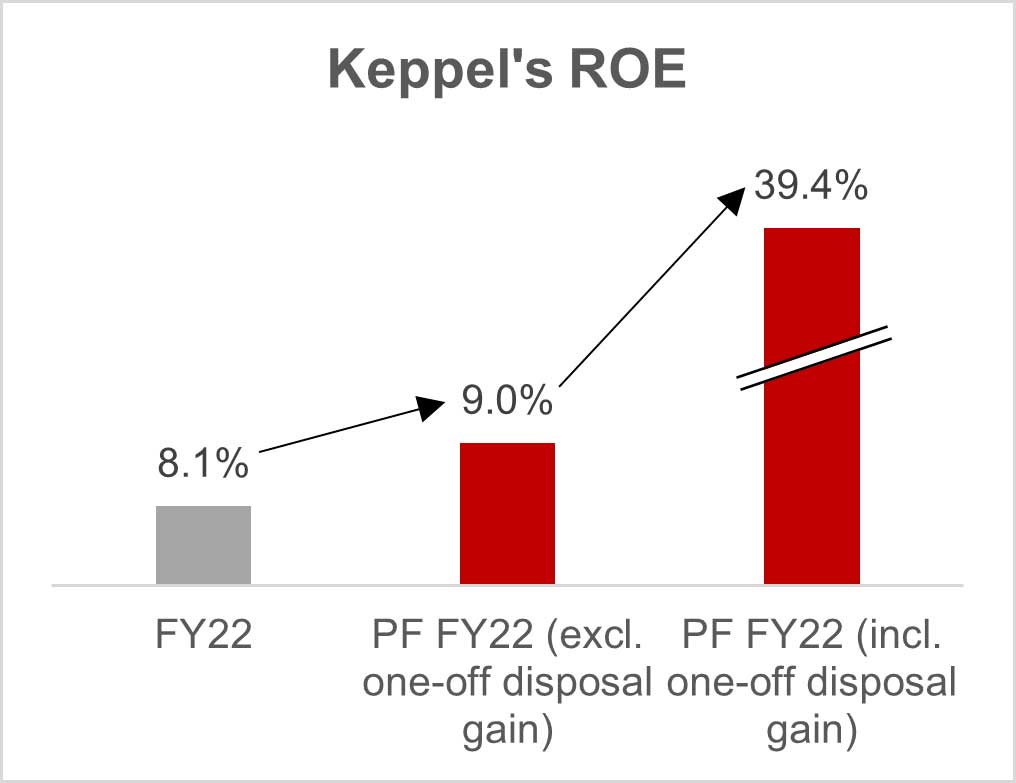

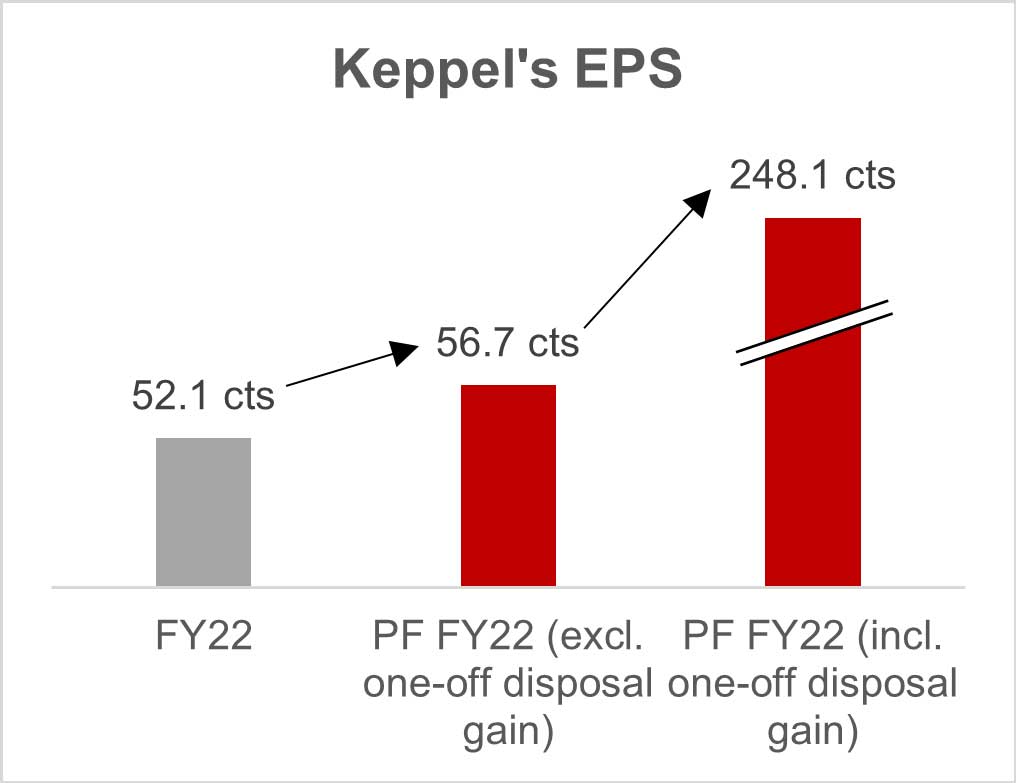

In addition, the O&M Transactions[5] will be ROE and EPS accretive for Keppel. To further illustrate financial effects of these transactions, the pro forma effects[6] of the transaction is shown below:

The completion of the O&M Transactions[5] marks a big step forward in Keppel’s Vision 2030 strategy, as the Group simplifies its business and transforms from a conglomerate into a global asset manager and operator, with strong capabilities in energy and environment, urban development and connectivity.

– END –

All capitalised terms not otherwise defined herein shall have the same meanings as defined in the Company’s circular to Shareholders dated 23 November 2022 in relation to the Proposed Transaction and the Proposed Distribution.

[1] Based on (a) 36,848,072,918 SCM Shares will be issued by Sembcorp Marine to the Company representing 54% of total number of SCM Shares on a fully diluted basis immediately after Closing, (b) the SCM Shareholders holding 31,389,099,152 SCM Shares, representing 46% of the total number of SCM Shares on a fully diluted basis immediately after Closing which, for the purpose of this computation, is the same number of SCM Shares held by the SCM Shareholders as at the last market day (26 April 2022) preceding the original announcement of the Proposed Transaction (“Last Market Day”), and (c) an issue price of S$0.122, being the volume weighted average price of SCM Shares for the last 10 trading days up to and including the Last Market Day.

[2] On pro forma basis assuming transactions were completed on 31 December 2022.

[3] Pro forma estimate of the value attributable to the SCM Shares received, calculated based on (a) 36,848,072,918 new SCM Shares will be issued by Sembcorp Marine to Keppel representing 54% of the issued and paid-up share capital of Sembcorp Marine on a fully diluted basis immediately after Closing, (b) the SCM Shareholders holding 31,389,099,152 SCM Shares, representing 46% of the issued and paid-up share capital of Sembcorp Marine on a fully diluted basis immediately after Closing which, for the purpose of this computation, is the same number of SCM Shares held by the SCM Shareholders as at Last Market Day, and (c) an issue price of S$0.122, being the Volume Weighted Average Price of SCM Shares for the last 10 trading days up to and including the Last Market Day. For the purpose of determining the aggregate value attributable to the KOM Consideration Shares on Closing, the Company will account for the actual value of the 54% equity interest in Sembcorp Marine based on the last traded price of the shares of Sembcorp Marine on the first trading day immediately following Closing and the actual number of SCM Shares to be issued on Closing.

[4] The pro forma value of the proposed distribution is calculated based on the proposed issue price of S$0.122, being the VWAP of SCM shares for the last 10 trading days up to and including the Last Market Day, per new SCM share and a total of 36,848,072,918 new SCM shares to be issued to Keppel on completion of the Proposed Transaction. In this regard, the actual value of the proposed distribution on completion will depend on the last traded price of SCM shares on the first market day immediately following the date of such completion and the actual number of SCM shares to be issued on Closing.

[5] O&M Transactions refer to the Keppel Offshore & Marine-Sembcorp Marine combination and the Asset Co Transfer.

[6] On pro forma basis assuming transactions were completed on 1 January 2022.